In a board meeting on Monday, California Public Employees' Retirement System (CalPERS), the $483 billion pension fund, approved a proposal to increase its target private equity allocation from 13 percent to 17 percent and outlined its updated strategy for the asset class.

The increase continues CalPERS's heavy focus on private markets following the fund’s ‘lost decade,’ the period between 2009 and 2018 in which CalPERS retreated from private equity just as the asset class exploded.

This week’s shift will boost CalPERS' total private markets exposure to 40 percent of assets under management, up from the current 33 percent. To accommodate the increase, the fund will pare back its public equity target allocation from 42 to 37 percent and fixed income from 30 to 28 percent.

"We have been transferring more equity risk from the public markets to the private markets, although public equity remains the largest portion of our portfolio. Buyout remains the largest portion of the private equity portfolio by far, at approximately 67 percent," said Anton Orlich, managing investment director for CalPERS’ private equity group.

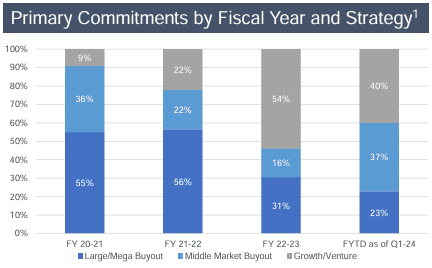

Buyout’s dominance, however, is waning. CalPERS has been gradually shifting commitments toward alternative strategies like venture and growth, believing that earlier-stage options may allow for more differentiation.

In fiscal year 2021, the fund committed 91 percent of its private equity dollars to buyout strategies. Year-to-date, that figure has dropped to just 60 percent.

Their rationale, according to Orlich: “This will provide a more diversified portfolio and give CalPERS the opportunity to generate alpha by participating in segments of the private equity space that have greater return dispersion. As a result, manager selection will have a greater impact.”

CalPERS is also planning to shake up its approach within buyout’s remaining allocation. Going forward, the pension fund sees the most opportunity in the middle market and has adjusted its manager selection accordingly. Through Q1 of this year, commitments to middle market funds outpaced those to the previously dominant larger end of the market for the first time.

Part of the motivation for this shift is a desire for greater exposure to sector specialists. Defined as managers with either a specific thematic or industry focus, the fund cited an “operational know-how which will provide a source of alpha.”

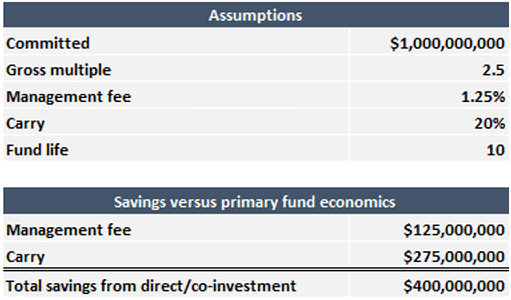

The final significant strategic goal from CalPERS’ update this week is a heavy focus on its co-investment activities, which it sees as the best way to boost returns thanks to the avoidance of management fees and carried interest paid to fund managers.

Board materials shared at the meeting included an illustrative scenario showing estimated savings of $400 million for every $1 billion committed to direct co-investment instead of traditional fund investments.

According to Orlich, potential savings could reach $25 billion over a 10-year period based on CalPERS’ target co-invest ratio of 40 percent.