Private equity analyst programs have become increasingly popular in recent years. Firms see it as a way to get a jump on the intense competition for top talent, while the top talent sees it as an opportunity to head straight to PE and avoid the mind-numbing two-years of investment banking.

These programs can be quite attractive and some firms offer a great experience. Just like anything else in finance, your experience will vary depending on where you land. The good news is that you’ll either set yourself up for an associate spot at the same firm, or retain a ton of optionality to pivot wherever you’d like.

What Does a Private Equity Analyst Do?

Actual work is largely similar to what an analyst in banking does. Expect a lot of PowerPoint, random research assignments, assisting in diligence analyses, admin work/scheduling, and modeling. You also may have some light exposure to portfolio company operations/management/reporting, depending on the firm.

It’s worth noting that analyst work at growth equity shops will also probably include a pretty heavy sourcing component. It depends where you end up, but some are well known for this. Plenty of people enjoy this type of work, but make sure you know what you’re getting yourself into.

Similarities & Differences vs. Banking

As in banking, you’ll start off with a lot of hand holding from your associate, but will have an opportunity to bite off more as you reach the end of your analyst stint.

The good news is you can avoid a lot of the tedious process-oriented work that’s so common in banking. You’ll be sending data request lists, rather than populating the data room. Everything you do will be from the perspective of an investor, rather than an advisor. But while PE analyst work certainly has the potential to be more interesting than banking, don’t expect to be presenting the super awesome and definitely very unique LBO idea you came up with to investment committee anytime soon.

Hours and work life balance will be fairly similar to what you’d see in investment banking. Just like anything else, this will vary by firm and team. Just don’t expect to be packing up at 5pm every day because you’re a big dog on the buy-side.

How to Become a Private Equity Analyst

These programs are highly competitive and you need to have a top profile to land a seat. Top target school, strong GPA, and prior closely related work experience (banking, PE, AM, etc.) are all prerequisites. There’s much less leeway for any non-traditional profiles here than banking given the number of applicants interested in such a small number of spots.

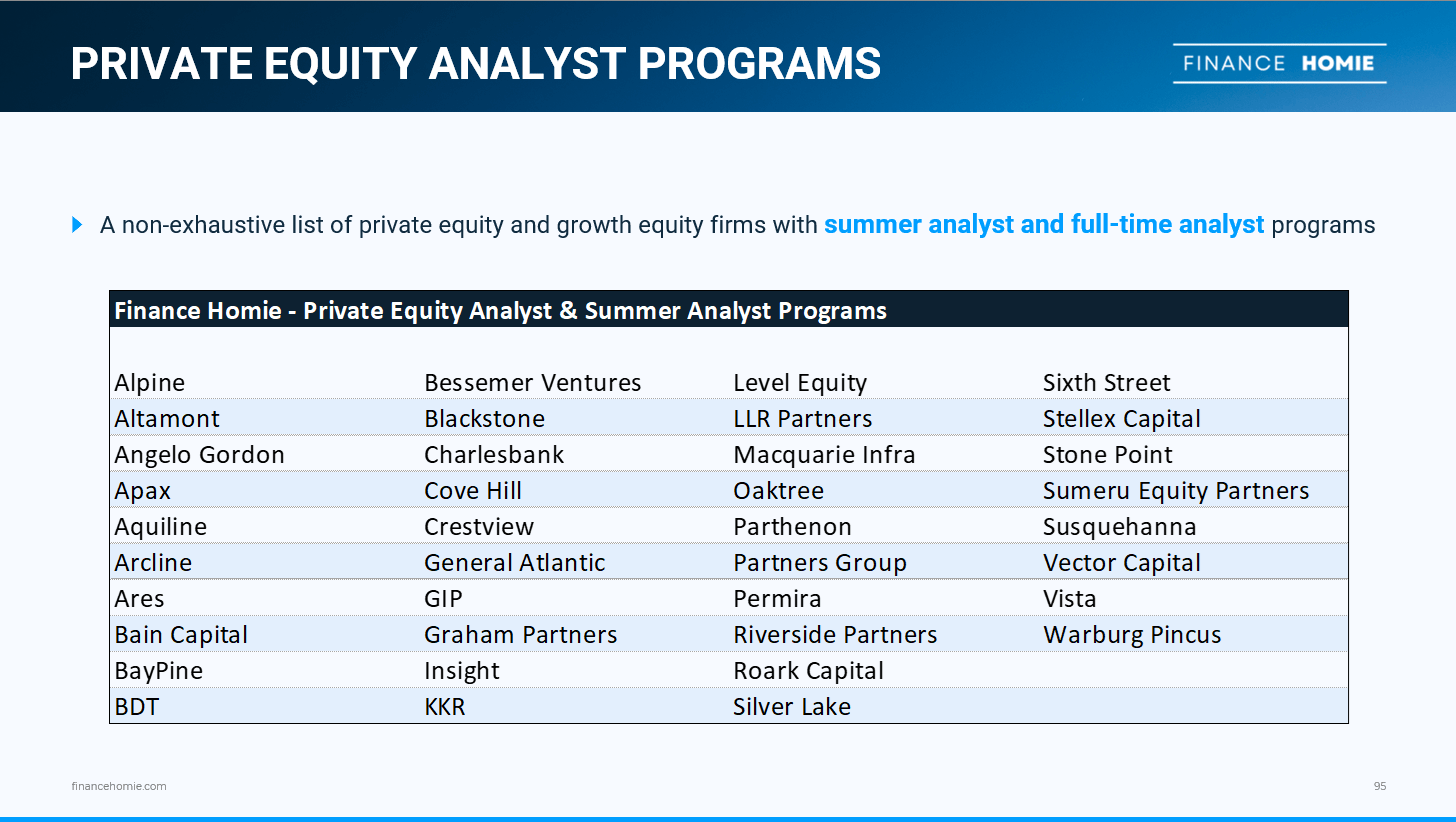

Some programs will hire for summer analyst positions that can then convert to full-time roles. Others only hire for full-time – it really depends on the specific firm and program.

Just like banking, networking is important and you should start early if you know you’re interested. If you’re at a target school you should have plenty of alumni to reach out to. If not, probably best to get started on the cold emails.

In contrast to associate recruiting, most analyst recruiting is run by the firms themselves, rather than headhunters. There’s not much difference to you with this approach, other than that the burden is on you to be proactive because headhunters won’t be reaching out.

Interview Prep

In terms of the actual interview, the process is a bit lighter touch than the standard associate interview. You’re less likely to do a full-length modeling test, and you won’t have much deal experience to talk about (maybe some comps you spread during your summer analyst stint).

However, it’s critical that you have a fundamental understanding of the drivers of leveraged buyouts, both from a practical and modeling perspective.

Case studies are more common in these processes. It’s unlikely to be a full blown four-hour, three-statement LBO-based test, but you’ll likely be given a potential investment to evaluate. Interviewees will want to see how you’re able to think through provided information and formulate a well-thought out response. The key here is to show that you’re able to “think like an investor.”

You should also have all of the standard investment banking technical questions locked down. It’s also a good idea to make sure you can do a paper LBO, both in case it comes up and because it will help build a baseline of knowledge to answer other LBO-related technical questions.

Exit Opportunities

Exit opportunities are quite strong at the majority of PE analyst programs. Firms will encourage top performers to stay on as an associate, and you’ll have the option to pursue the traditional headhunter-led associate process for other firms.

The PE analyst skillset is highly sought-after, and you will get good looks from other firms if you decide to recruit out. Headhunters have told me that PE firms have had a lot of issues with turnover within the analyst program as they spend time, effort, and money to train analysts, only to have them leave for a larger fund just after they’re starting to become useful.

You’ll also get strong interest from hedge funds, particularly if you’re exiting from a well regarded UMM or MF program. If you know you’re interested in public markets roles, the PE analyst path is a great way to set yourself up to break in a couple years early (vs. more typical 2 + 2 banking and PE).

For those that are interested in earlier stage investing, there’s also ample opportunity to explore roles across growth equity and venture capital. Note that for those coming out of growth equity analyst programs, exiting may be slightly more difficult if you had higher than average sourcing work (at the expense of modeling).

If you do decide to recruit out, it’s important that you have strong reviews and secure an offer to stay. It’s not insurmountable if you don’t, but it will be a topic of conversation with headhunters.

Private Equity Analyst Salary & Compensation

PE analyst compensation is largely similar to that of banking, perhaps with a slight skew toward the upside. All-in comp will likely be somewhere in the neighborhood of $175k – $250k through your analyst years. Maybe a tad less than someone at Centerview or Qatalyst, but nothing to sneeze at for your first year out of school.

The other benefit of junior private equity roles is that there won’t be as much variation in bonuses as there is in banking. With cash comp paid out of management fees there’s (almost) no risk of a donut, and when banking fees are down you’ll certainly be doing better than the sell-side homies.

So Should You Target a PE Analyst Program?

On the whole, private equity analyst programs are great opportunities and you should go for it if you get the chance. If you don’t like it you still have plenty of opportunity to pivot elsewhere, and you’ll build a great skillset over the first 2-3 years of your career.

Increasingly, firms are prioritizing associate recruiting primarily from their analyst class. So this route may stat to be the only way in to a handful of highly selective firms.

Investing

There’s a lot to be said for starting off your career as an investor. You’ll develop mental frameworks and a level of critical thinking that simply won’t happen in banking. Most banking analysts, myself included, crank out some numbers that don’t mean anything to us and then call it a day, hoping we don’t get too many comments.

Investment professionals, on the other hand, actually have a vested interest in what the numbers say and mean. You’ll add the interpretive component that’s missing in banking, which can be fun, exciting, and supremely stressful all at the same time. No matter what your personal reaction to this type of work is, there’s no doubt that it’s an incredible skillset to have throughout your career and life.

While your banking friends are trying to figure out how $10 flows through the three statements, you’ll be opining on the merits of various LBO targets.

Social Aspect of Private Equity

One part of the private equity analyst job that often doesn’t get airtime in discussions like this is the social element. When you’re starting out as a junior at a PE firm, you’ll quickly realize that the environment is very different from working as an analyst at a bank. Your class size will be much smaller, which means significantly less opportunity to create the friendships that make banking tolerable. It’s not uncommon to have one person from each level on a deal team. So one analyst, one associate, one VP, etc., which means you won’t have a chance to experience life in the trenches with your other analyst homies.

It may be firm dependent, but I’ve also found PE to be just generally more uptight, slimy, and cutthroat than banking. I used to have fun going into work back in the banking days. Now it’s much more likely to be an unpleasant experience just based on the number of interactions you’re forced into with people that you would actively avoid if you weren’t stuck in the same office with them. It’s one thing to deal with this environment now, but I don’t think it would’ve been very tolerable immediately out of school.

That said, the solitary nature of private equity and investing roles can be a great fit for certain personalities. If you want to dive into a diligence deck for 36 hours straight, lose all your friends and family, and spend Fridays talking about roll-up strategies at happy hour before going back to work, then you should dive right in. An exaggeration for sure, but this will happen and you will meet people like this.

The Final Word

Don’t let that scare you away though, it’s still probably going to be a great experience. The good news is you also don’t need to worry if you decide against a PE analyst role or can’t land one. You’ll still have the same level of optionality from top banking programs, so there’s not really a wrong answer.